The time vs money conundrum. This does sound like a jargon, albiet an intuitive one. In its most basic form, it's a question; what is more important to you, time or money? You will hear honest answers and dishonest answers from all kinds of people.

But have you ever wondered how it applies in your life? Not in a finance class test, not while discussing earnings potential with your fellow investment bankers during Thursday drinks, but in your day to day life?

I used to earn 20,000 INR (≈ $250/month) 10 years ago. I was a happy go lucky person, rarely thought about saving, but thought very much about being seen using the latest fragrance from Bath & Body Works. I used to spend my entire salary on fragrances (think amazing smelling candles and lotions), rent, food and commute. This went on for 3 years. I saved zilch, save for some sad and unused candles. I studied engineering, and nobody had told me the importance of saving money. I now wish there was a basic finance class for everyone.

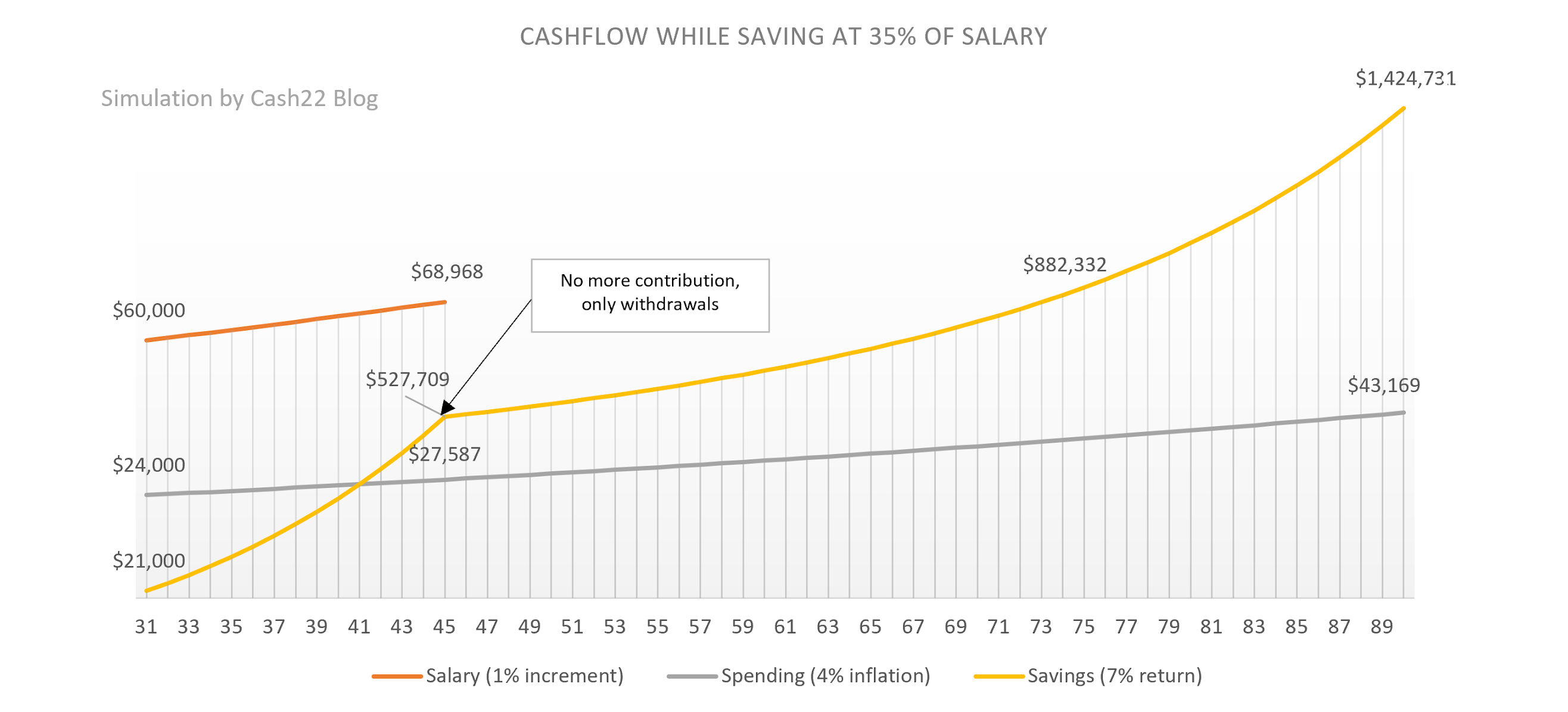

I was lucky; I did get interested in basic finance as I started to earn more. By 2016, I was able to save around half my salary. I assumed I would work a long time; my salary would keep increasing and all will be happy and glittery, and I'll be able to retire by 55.

6 months ago, something changed. As I was driving to work, I realized I didn't want to do this forever. Spending precious awake hours stuck in traffic seemed futile. I think working from home the last 18 months triggered this feeling. I started number crunching.

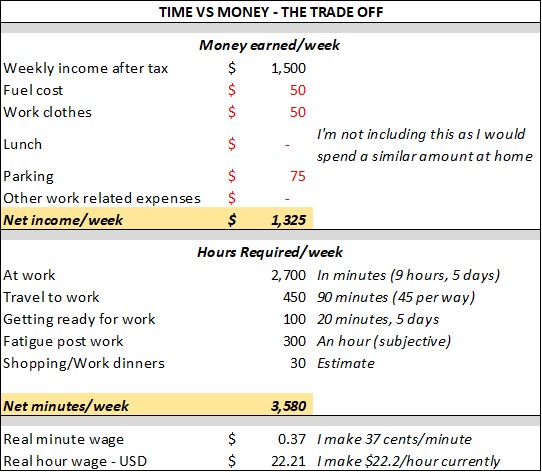

After some faithful number crunching, I realized for every Bath & Body Works candle that I will buy in the future, I will have to work an additional one hour of my life. I started looking at spending my time and money differently. I downloaded my last credit card bill and converted all my transactions to minutes. I spent a $100 on a beautiful blazer from Zara - that roughly translates to an additional half a day worth of work - and suddenly, the blazer's not that beautiful anymore. Every dollar you spend means an equivalent time that you will spend working. Once you can internalize that concept, you would make more time + money conscious choices.

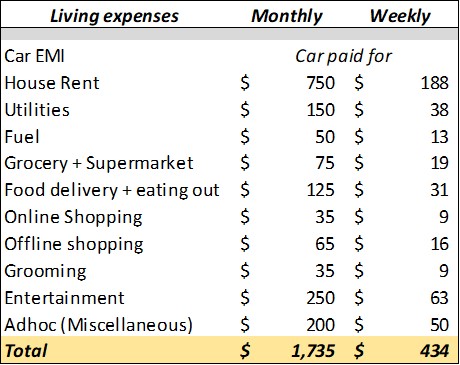

In order to retire early, we need to do some more math. How much money do I need post-retirement on a weekly or monthly basis?

I believe where you retire plays a huge role. But that's a topic for another day. Let's assume I retire in the same city I live in - I will land up spending about $450 per week - rent (assuming I don't own a house), utilities, food, medical insurance, fuel (assuming my car is paid for), travel, dinners and some miscellaneous.

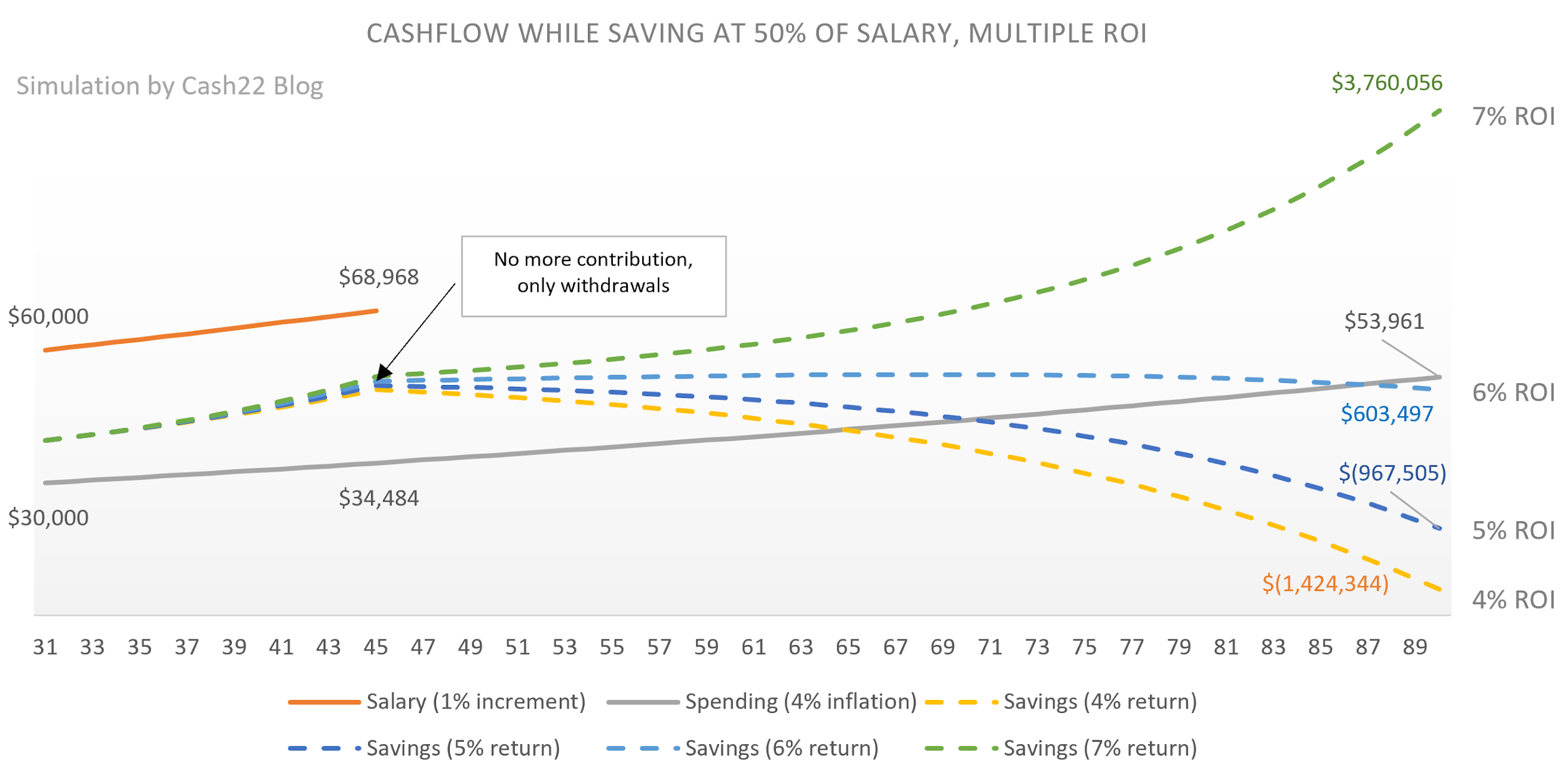

In the below simulation, if we were to save 50% of our salary and spend the other 50%, our investment strategy becomes very important. You will most likely go into negative cashflow if you simply keep your money in a bank account in spite of saving 50%. Even a FD may not be the best solution unless your bank is giving you at least 6% (post tax) returns. Anything over 7% is going to ensure a comfortable life and retirement at 45.

How much you spend today will determine when you retire. It's a difficult truth to internalize, imagine converting all those credit card transactions to equivalent hours you will have to work? I think that's the essence of the time vs money conundrum in real life.

Note - If you are looking for editable versions of the above graphs, please email me at shrutidshah@gmail.com

Credits - the first photo is from Nastuh Abootalebi on Unsplash

Comments

Post a Comment